Exploring the Price Tag of Golf Cart Insurance: What to Expect

Key Takeaways:

- Golf cart insurance is important for protecting your investment and ensuring financial protection in case of accidents or damages.

- Understanding the different coverage options and factors that affect the cost of golf cart insurance can help you make informed decisions and find the best policy for your needs.

- It is crucial to choose a trusted insurance company and familiarize yourself with the coverage and claims process to ensure a smooth experience in case of a claim.

Introduction: Understanding the Importance of Golf Cart Insurance

Golf cart insurance plays a crucial role in protecting your investment and ensuring your peace of mind. In this section, we will explore the significance of golf cart insurance, highlighting its key benefits and providing an overview of what it entails.

So, whether you enjoy leisurely rides around the neighborhood or use your golf cart for transportation purposes, understanding the importance of golf cart insurance is essential to safeguarding your vehicle and yourself in case of unexpected events.

Overview of Golf Cart Insurance

Golf cart insurance gives coverage and protection for golf cart owners. It ensures that they will be financially protected if there are accidents, damages, or injuries related to their vehicles. It’s different from regular car insurance because of the unique nature and usage of golf carts.

Golf cart insurance has various coverages tailored just for golf cart owners. Basic liability insurance is a common option that covers property damage and injuries caused by the golf cart owner. Its cost varies by the value of the golf cart, usage frequency, and the owner’s driving record. Collision and comprehensive coverage can also be added for more protection.

In some states, homeowners’ insurance may provide some coverage for golf carts. But, it’s often not enough. So, separate golf cart insurance policies are usually recommended for better protection. In states like Florida, the policy should be carefully chosen since golf carts are used as transportation.

Modifications to golf carts may call for extra insurance requirements. Modified golf cart owners must make sure they have adequate coverage that deals with any increased risks from their modifications.

To get discounts on golf cart insurance premiums, people can bundle policies with other insurances like homeowners’ or auto insurance. Safety measures can also help reduce premiums, such as security devices and approved safety courses.

Key Benefits of Having Golf Cart Insurance

Golf cart owners should consider getting insurance. It provides several benefits.

- For starters, it can cover repairs or replacements if something goes wrong.

- Secondly, it offers liability protection against claims for injuries or property damage.

- It can also cover medical bills, legal fees, and more.

Moreover, golf cart insurance often includes extra coverage options. Such as theft protection and coverage for accessories or modifications. This ensures owners get the protection they need. Also, some states or communities require golf cart insurance. Making it a must-have for some owners.

Overall, golf cart insurance is a smart move for all owners. It can protect them financially, meet legal requirements, and provide peace of mind. By getting a policy from a reliable insurer, owners can enjoy their golf cart worry-free.

Golf Cart Insurance Rules and Considerations

When it comes to golf cart insurance, there are important rules and considerations to keep in mind. From state variations in insurance rules to the distinction between regular car insurance and golf cart insurance, this section will provide insights into the legal requirements and added protection options. Understanding these factors will help you navigate the complexities of insuring your golf cart effectively.

State Variations in Golf Cart Insurance Rules

Golf cart insurance rules can differ significantly from state to state in the U.S. Knowing these variations is essential for golf cart owners who want to make sure they have the right coverage.

It may be mandatory or optional to have insurance in some states. Owners need to understand their state’s requirements and adhere to them.

Coverage and liability limits may vary too. Some states may have low minimums, while others may have higher ones or additional coverage requirements. It’s important to know what these are.

Street-legal golf carts usually require more coverage than those only for off-road use. State regulations determine if a golf cart is allowed on public roads.

Golf carts may have additional restrictions, such as speed limits or designated areas. Insurance requirements could reflect these risks.

Rules for golf cart insurance change, so owners should review them regularly to make sure they’re complying with the law.

It’s important to understand state variations in golf cart insurance rules. Being aware of the requirements and having coverage helps protect from potential liabilities and losses. Even if the legal requirements protect you, added protection will ensure your golf cart isn’t a lawsuit waiting to happen.

Legal Requirements vs. Added Protection

Legal requirements and added protection are two important factors to consider when insuring your golf cart. Knowing the difference can help you make informed decisions.

State Rules:

Rules for golf cart insurance vary from state to state. Some states may require minimum liability coverage, while others may need extra protection.

Basic Liability vs Added Protection:

Basic liability insurance covers damages or injuries caused by your cart. It may not cover theft, damage to your own cart, or medical expenses. Added protection options can provide enhanced coverage for these situations.

Not Like Regular Car Insurance:

Golf cart insurance is different from regular car insurance in terms of coverage and cost. Premiums may be lower but coverage is limited.

Factors Affecting Premiums:

Your golf cart insurance premium may depend on the value of your cart, its usage, your driving history, and location. Adding collision coverage, comprehensive coverage, or uninsured motorist coverage can provide extra protection.

Bundling and Discounts:

Bundle your golf cart insurance with other policies to get discounts. Take safety precautions to lower premiums.

Claims Process:

Know what damages and injuries are covered and how to file a claim. Pick a trusted insurance company that specializes in golf cart insurance.

Negligence Factor:

Filing lawsuits related to golf cart accidents has time limits. Compensation options are available for those involved in accidents.

Fun Fact: People modify golf carts for off-road use!

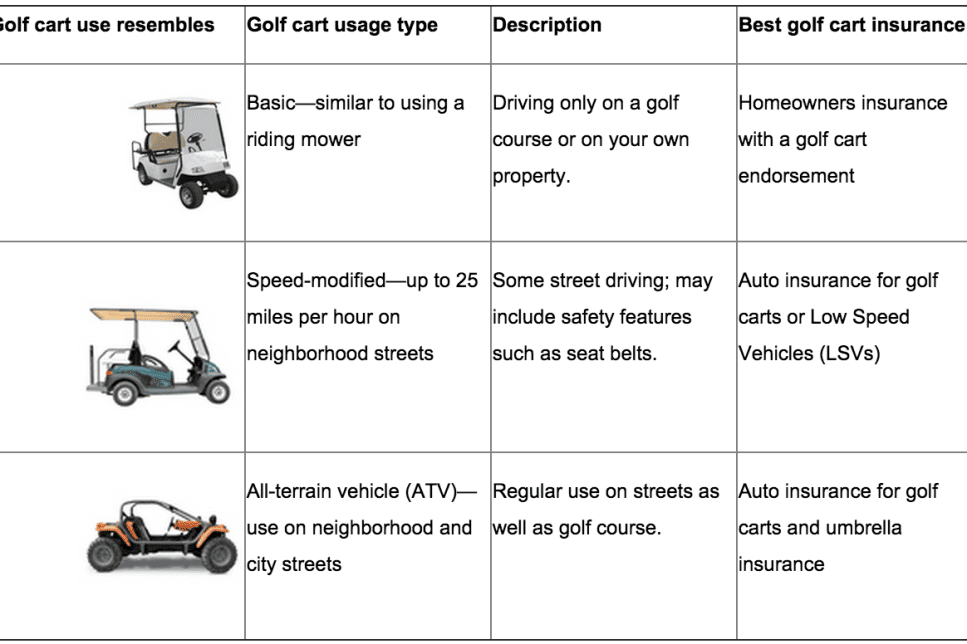

Distinction between Regular Car Insurance and Golf Cart Insurance

Golf cart insurance is not the same as regular car insurance. Regular car insurance is for vehicles used on public roads, whereas golf cart insurance is made for golf carts used for fun.

Let’s compare them in a table:

| Aspect | Regular Car Insurance | Golf Cart Insurance |

| Intended Use | Public roads. | Recreational purposes. |

| Coverage Scope | Liability, collision, comprehensive, and more. | Mainly liability, and extra protection for golf carts. |

| Premium Determination | Getting the best coverage for your golf cart is like a hole-in-one! It requires skill, accuracy, and a good attitude when premiums get expensive. |

Understanding the Coverage Options and Factors Affecting Cost

Understanding the coverage options and factors affecting the cost of golf cart insurance is essential for every golf cart owner. In this section, we’ll explore the basics of liability insurance and its associated costs.

We’ll also uncover the various factors that can influence the premiums of golf cart insurance policies. Furthermore, we’ll highlight the importance of adding additional coverages to enhance protection. So, let’s dive into the specifics and make informed decisions when it comes to insuring your golf cart.

Basic Liability Insurance and its Cost

Basic liability insurance for golf carts covers costs for property damage or injuries caused by the insured cart. This insurance cost depends on the value of the cart, chosen coverage limits, and location. Though basic liability insurance offers protection, it may not cover all risks or damages. Owners can add extra coverages for more protection.

Premiums for golf cart basic liability insurance differ based on factors such as value, usage frequency, location, coverage limits, extra coverages, driver’s age, and driving record. To get accurate insurance cost for a specific cart, request quotes from different providers and compare.

Basic liability insurance for golf carts only covers property damage or injuries to others caused by the insured cart. It does not cover damage to the cart itself or injuries for occupants. To get further protection, owners should consider additional coverages like collision coverage, uninsured/underinsured motorist coverage, and medical payments coverage.

Understanding these details helps golf cart owners make informed decisions about insurance needs. By considering factors which affect premium costs and evaluating extra coverages, owners can choose a policy with the right coverage at a reasonable price.

Factors Affecting Golf Cart Insurance Premiums

Various factors influence golf cart insurance premiums. Knowing these elements is essential for assessing costs and securing protection.

Some of the factors include:

- State regulations

- Usage patterns

- Driver age/history

- Modifications

- Selected coverages

- Claims history

Extra details may also be factored in, such as discounts or incentives based on factors like safety features or defensive driving courses.

One noteworthy story involves a golf cart that had been modified with high-performance parts and customized bodywork. The owner was warned that the premium would be much higher than usual. This shows how modifications can cause insurance prices to rise.

Secure your golf cart with additional coverage for the ultimate protection.

Importance of Adding Additional Coverages for Enhanced Protection

The importance of extra coverages in golf cart insurance can’t be stressed enough. To get full protection, it’s important to include these coverages in the policy. They are there to guard against any risks that arise while driving golf carts.

For starters, enhanced property damage coverage is essential. By adding collision or comprehensive coverage, golf cart owners can be financially safe in case of accidents, theft, vandalism, or natural disasters.

Also, boosting liability protection is important. Added liability coverage protects owners from costly legal matters if there is bodily injury or property damage caused by the insured golf cart. This could be really helpful if the usual liability limits are not enough.

In addition, coverage for personal belongings is recommended, especially for owners who often carry valuable items while using their golf carts.

Medical payment coverage is also worth looking into. It covers medical bills due to accidents involving the insured golf cart.

Uninsured/underinsured motorist coverage is also a good idea. It safeguards in case an uninsured or underinsured driver causes an accident involving the insured golf cart.

It’s important to note that each state has different regulations for coverages and requirements for owning and operating a golf cart. Understanding these differences is key to comply with state laws and have proper protection.

To further enhance protection, consulting with a reliable insurance agent who specializes in recreational vehicle insurance is a great idea. Doing regular maintenance checks on the golf cart can reduce risks of mechanical failures or accidents. Additionally, maintain a clean driving record and take safety training courses to lower premiums and show responsible ownership. Periodically review and update insurance policies to make sure coverage is adequate.

By adding extra coverages to golf cart insurance policies, owners can protect against risks and financial burdens. It’s important to know the available coverage options and state regulations to make informed decisions. In the end, even if I don’t get a hole-in-one, my golf cart insurance policy has me covered.

Golf Cart Insurance Options and Policies

Discover comprehensive golf cart insurance options and policies including limitations, coverage scope, separate policies, specific considerations in Florida, and additional insurance requirements for modified golf carts. Stay informed about the diverse range of coverage offered and ensure you have the necessary protection for your golf cart.

Homeowners Insurance: Limitations and Coverage Scope

Homeowners insurance may provide some coverage for golf carts, but its restrictions and scope are significant. It is important to review the policy to understand these limitations. Coverage may not extend to accidents off the property. Folks who use golf carts away from their property or need extra liability protection should purchase separate golf cart insurance.

Homeowners should be aware of limitations and decide if their insurance offers enough coverage. Examining policy details and understanding restrictions and coverage scope can help homeowners make informed decisions on protecting themselves and their golf carts.

Separate Golf Cart Insurance Policies

Golf carts have unique risks, so separate golf cart insurance policies are made just for them. These policies provide coverage for property damage, bodily injury, theft, and more.

Having a policy for your golf cart can be beneficial, as it offers specialized coverage not found in other types of insurance. It helps protect you from financial losses and legal liabilities as well.

Before buying a policy, you should assess what your homeowners insurance covers. It may only provide limited coverage for golf carts. With a separate policy, you get comprehensive coverage tailored to your needs.

In conclusion, having a golf cart insurance policy is essential for protection against these unique risks. It gives you peace of mind knowing you have reliable coverage, should any unexpected incidents occur.

Florida Golf Cart Insurance: Specific Considerations

Florida golf cart insurance has special details that owners need to be aware of. In Florida, golf carts are not classed as motor vehicles, so a personal auto insurance policy is not necessary. Instead, owners have the option of buying separate golf cart insurance plans that cover their vehicles.

An essential thing to know in Florida is the need for liability coverage. All motor vehicle owners, including golf cart owners, must have the minimum liability coverage. This ensures owners have financial protection if there is an accident that causes property damage or injury.

Also, depending on how a person uses their golf cart, they may want to consider extra coverage beyond basic liability insurance. Comprehensive coverage can protect against harm from theft, vandalism, or natural disasters. Collision coverage provides financial protection in case the golf cart is in an accident with another object or vehicle.

It’s key for Florida golf cart owners to understand that modified golf carts could have other insurance demands. If changes are made which alter the design or performance of the golf cart, it can affect if certain types of insurance coverage are available.

In summary, Florida golf cart insurance has particular considerations that owners should understand. Liability coverage is mandatory, and extra coverage options may be beneficial depending on how the golf cart is used. Modified golf carts could have different insurance requirements. Owners should expect possible price changes when insuring modified golf carts.

Modified Golf Carts and Additional Insurance Requirements

Owners of modified golf carts need to be aware of extra insurance needs. Such modifications include lifted suspensions, bigger tires and more speed. This raises the risk of accidents and damages, so the right insurance is key.

Basic liability insurance covers damage to others, but not the modified cart itself. For full protection, owners should get added coverages. A separate golf cart policy tailored to the modded cart is recommended. Homeowners insurance may not cover recreational vehicles like carts, especially when modified.

In conclusion, owning a modified golf cart comes with extra insurance requirements. It is best to get a separate golf cart insurance policy for adequate protection. Understanding these needs and getting the right insurance coverage will safeguard owners financially in case of any accidents or damages.

How to Save Money on Golf Cart Insurance

Save big on your golf cart insurance with proven strategies! Discover effective ways to cut costs and maximize savings with bundled packages and special discounts. Additionally, gain valuable insights on reducing premiums with expert tips. Don’t miss out on these money-saving opportunities for your golf cart insurance!

Bundling and Discount Opportunities

Saving money on golf cart insurance? Bundle it with other policies like homeowners or auto insurance! You can get discounted rates when you combine multiple policies with the same provider. Multiple vehicles? Insure them with the same company for lower premiums. Plus, safe driver discounts for those with a clean driving record.

Some insurers offer discounts to members of certain clubs/organizations. Age-based discounts too. And loyalty rewards programs for long-term customers. Review the terms & conditions and compare quotes for the best deal. Lastly, speak to an insurance agent or expert for personalized advice. Bundling & discount opportunities = savings on golf cart insurance premiums!

Tips for Reducing Premiums

Reducing premiums for golf cart insurance is key for responsible ownership. There are ways to save money on premiums. These tips focus on factors that can influence the cost of insurance and how to minimize them.

- Increase the deductible: Opting for a higher deductible can lead to lower rates. But choose an amount you can afford if an accident or damage happens.

- Look for discounts: There may be discounts for things like combining policies, taking a defensive driving course or installing safety features. Check these out.

- Pick coverage wisely: Understanding the needs and risks related to golf carting can help tailor coverage. This avoids extra costs.

- Stay safe: Good driving habits can lead to lower premiums. Avoid accidents and traffic violations to keep costs down.

These tips offer practical steps to reduce insurance premiums. Careful consideration of deductibles, taking advantage of discounts, selecting coverage options and keeping a clean driving record can help save money while ensuring adequate protection.

Understanding the Coverage and Claims Process

Understanding the Coverage and Claims Process: Explore the different aspects of golf cart insurance, including coverage for property damage and injuries, as well as the importance of choosing a trusted insurance company. Discover how to navigate the claims process effectively and ensure you have the right coverage for your golf cart.

Coverage for Property Damage and Injuries

Golf cart insurance is a must to protect both the owner and anyone hurt in an accident. Policies often have liability coverage, which covers property damage and injuries to another person. Comprehensive coverage can cover damages to the golf cart itself, no matter who’s at fault.

Property damage coverage may pay for repairs or replacement of structures like fences, buildings, and vehicles. Bodily injury liability coverage may cover medical expenses, rehab costs, and lost wages of someone hurt in a golf cart accident.

The coverage limits and extent may depend on the policy and state regulations. Thus, it’s important to review your golf cart insurance policy carefully to understand the details, including exclusions or limitations.

Picking the right insurance company is as important as using a golf cart with brakes.

Importance of Choosing a Trusted Insurance Company

When it comes to golf cart insurance, choosing a trusted insurance company is essential. You must have the reliability and financial stability of a dependable insurance provider. Making the right choice is key – it can make all the difference in an accident or claim.

A good insurance company will provide the right coverage and support for any claims. They will be known for great customer service, so you’ll get quick attention and assistance with your claim. Plus, they have a history of honoring policies and providing fair compensation.

Not all insurance companies are the same when it comes to golf cart insurance. Some might offer bad coverage or deny claims without reason. That’s why it’s vital to select a trusted insurance company – for peace of mind and protection.

By choosing a reputable insurance provider, your golf cart is covered by a comprehensive policy. This lets you relax and enjoy your time on the greens – without worrying about accidents or damages.

Golf Cart Insurance Lawsuits and Compensation

Golf cart accidents can lead to lawsuits and compensation claims. Let’s explore the negligence factors in these accidents, the process of filing lawsuits and time limitations, as well as the compensation options and the involvement of insurance providers.

Negligence Factors in Golf Cart Accidents

Negligence in golf cart accidents can be damaging. To stop these incidents, it’s essential to know the various elements at play. These include:

- Improper maintenance. Not regularly inspecting and servicing the cart’s mechanical parts, like brakes or steering, can lead to malfunctions.

- Driver error. Dangerous driving, like overspeeding, failing to yield right of way, or driving while impaired, can cause accidents.

- Lack of safety precautions. Not wearing a seatbelt or using safety features, allowing unauthorised persons to drive, or disregarding traffic rules can all contribute to accidents.

Each incident is different, but by being responsible and aware of negligence factors, individuals can minimise the risk of accidents and keep themselves and others safe.

Filing Lawsuits and Time Limitations

Filing lawsuits for golf cart accidents? You need to consider time limitations. Get to grips with the legal requirements and time restraints for seeking compensation.

Start with a personal injury attorney who specializes in golf cart accidents. They’ll help determine if your case is valid.

Then, be aware of the statute of limitations. That’s the time frame to file your lawsuit. It differs in different jurisdictions.

Gather evidence: photos, witness statements, medical records, and more. Your attorney will draft a complaint with details and file it with the court.

Prepare for the legal process: negotiations, mediation, or even a trial. Know that state laws may vary. Consult an experienced attorney.

Insurance matters as well. Get the coverage you need to avoid being stuck in a sand trap.

Compensation Options and Insurance Provider Involvement

Compensation options and insurance provider roles when it comes to golf cart insurance are essential. In the event of an accident or damage, it’s important to know the available compensation options and how insurance providers are involved.

To provide an overview, we created a table. This table shows key details such as coverage for property damage and injuries, filing lawsuits, time limitations, and the role of insurance companies in the compensation process.

The table below demonstrates elements related to compensation and insurance provider involvement in golf cart insurance:

| Coverage Options | Property Damage | Injuries | Lawsuits | Time Limitations | Insurance Provider Role |

|---|---|---|---|---|---|

| Compensation for damages to other party’s property | Provides coverage | Coverage may include medical expenses | Litigation may be required | Statutory limitation periods | Assistance through claims process |

| Compensation for personal injuries from an accident involving a golf cart | May cover medical expenses | May include lost wages and rehabilitation costs | Depending on circumstances | Statutory limitation periods | Support with legal representation |

It’s important to acknowledge that this table gives a general overview. Terms and conditions may differ based on policies and state regulations. For personalized information, contact your insurance provider.

To sum up, understanding compensation options and insurance involvement ensures responsible ownership. This gives you adequate protection in case of any accidents or damages related to your golf cart.

Conclusion: Making Informed Decisions about Golf Cart Insurance

Making informed decisions about golf cart insurance is crucial. In the conclusion, we’ll explore final thoughts and delve into the importance of responsible ownership. Stay tuned for valuable insights that will help you navigate the world of golf cart insurance.

Final Thoughts and Importance of Responsible Ownership

Golf cart ownership demands understanding the significance of having golf cart insurance. It is essential to have appropriate coverage to guard against potential liabilities and accidents. Golf cart insurance supplies financial security and peace of mind. Therefore, owners can benefit from their vehicles without worrying.

The importance of responsible ownership involves knowing that golf cart insurance is not optional. It may be attractive to avoid insurance to save cash. However, it is vital to contemplate the potential consequences of not having protection. Golf carts can cause property damage or injuries in accidents. Without insurance, owners may be liable for considerable expenses.

Apart from comprehending the legal requirements for golf cart insurance, responsible ownership also implies pondering additional coverages that enhance protection. Basic liability insurance is necessary. But, adding other coverages such as collision and comprehensive can provide broader and more complete coverage. These additional coverages guarantee that owners are adequately protected against various risks and potential damages.

It is noteworthy that rules for golf cart insurance differ across different states. Owners should be acquainted with the specific requirements in their state. Plus, any restrictions or scope set by homeowners’ insurance policies. Further, modified golf carts may have additional insurance requirements due to their altered nature.

To ensure responsible ownership, it is essential to select a dependable insurance company with experience in providing golf cart coverage. In the event of an accident or claim, having reliable customer service and effective claims processing is vital.

Some Facts About How Much Is Golf Cart Insurance:

- ✅ Golf cart insurance can be obtained through homeowners insurance or as a separate policy. (Source: flawlessgolf.com)

- ✅ Basic liability insurance for golf carts can be obtained for around $75 per year. (Source: progress.com)

- ✅ The cost of golf cart insurance may vary based on factors such as age, location, driving history, and cart specifications. (Source: progress.com)

- ✅ Additional coverages can be added to a golf cart insurance policy for increased protection in case of an accident. (Source: progress.com)

- ✅ To save money on golf cart insurance, bundling it with homeowners insurance and choosing a higher deductible are recommended. (Source: progress.com)

FAQs about How Much Is Golf Cart Insurance

How much is golf cart insurance?

The cost of golf cart insurance can vary based on factors such as age, location, driving history, and cart specifications. Basic liability insurance can be obtained for around $75 per year with Progressive. However, the price may differ depending on the insurance company and any modifications made to the golf cart.

Do I need a specialized golf cart insurance policy?

While golf cart insurance rules vary by state and it may not be a legal requirement in all areas, it is worth considering a specialized golf cart insurance policy for added protection in case of an accident. Regular car insurance does not cover golf carts, so a specific golf cart insurance policy is necessary.

Can I add golf cart insurance as a rider to my homeowners insurance?

Adding a golf cart as an insurance rider on a homeowners insurance policy only provides coverage when the cart is on your property. If you plan to drive the golf cart off your property or use it for community and recreational purposes, separate insurance coverage is needed.

What is the average cost of golf cart insurance in Florida?

Golf cart insurance in Florida can cost as little as $75 per year, but the price may vary depending on the insurance company, modifications to the golf cart, and policy add-ons. Bundling golf cart insurance with other insurance policies can start at $50 a year and provide coverage both on and off the golf course.

What does golf cart insurance cover?

Golf cart insurance typically covers property damage and injuries to others if you are at fault in an accident. The specific coverage options include bodily injury and property damage liability, guest passenger liability, collision and comprehensive (optional) coverage, medical payments coverage (optional), and uninsured/underinsured motorists (optional) coverage.

How can I save money on golf cart insurance?

To save money on golf cart insurance, you can bundle it with homeowners insurance, pay annual premiums in full, sign up for automatic payments, and choose a higher deductible. Taking advantage of any available discounts, such as safe driving or homeowners discounts, can also help reduce the cost of golf cart insurance.